About JFBAJournal of Fintech and Business Analysis is an open-access international academic journal published irregularly, which is hosted by Beijing Computer Federation, and published by EWA Publishing. It primarily publishes articles related to digital economy, financial technology, and business analytics. The aim of JFBA is to focus on the development trends in digital economy, gathering academic insights in research areas such as digital economic growth theory, digital industry studies, industrial digitalization research, and digital governance. Additionally, it covers fields such as cloud computing, edge computing, blockchain technology, data science, case analysis and marketing in the financial technology and business analytics domain. JFBA provides valuable academic outcomes to scholars, professionals, and readers in these related fields to promote academic exchange. For more details of the JFBA scope, please refer to the Aim & Scope page. For more information about the journal, please refer to the FAQ page or contact info@ewapublishing.org. |

| Aims & scope of JFBA are: ·Digital Economy ·Financial Technology ·Business Analytics |

Article processing charge

A one-time Article Processing Charge (APC) of 450 USD (US Dollars) applies to papers accepted after peer review. excluding taxes.

Open access policy

This is an open access journal which means that all content is freely available without charge to the user or his/her institution. (CC BY 4.0 license).

Your rights

These licenses afford authors copyright while enabling the public to reuse and adapt the content.

Peer-review process

Our blind and multi-reviewer process ensures that all articles are rigorously evaluated based on their intellectual merit and contribution to the field.

Editors View full editorial board

Lahore, Pakistan

London, UK

an.nguyen@kcl.ac.uk

London, UK

canh.dang@kcl.ac.uk

Birmingham, UK

Chinny.Nzekwe-Excel@bcu.ac.uk

Latest articles View all articles

This paper examines the viability of high-frequency pairs trading in China's A-share market using minute-level data across three GICS sectors. Applying a Bollinger-band framework to 4,500 cointegrated stock pairs, we document consistent—though moderate—gross profitability. We then conduct trade-level regressions to isolate drivers of profitability and identify three key determinants: spread volatility, market-cap disparity within pairs, and multi-frequency return correlations. Further diagnostics show that execution latency significantly erodes returns, convergence reliability closely aligns with estimated half-lives, and exit effectiveness varies asymmetrically across long and short trades. Sector-level results reveal that Consumer Discretionary delivers the strongest risk-adjusted performance, while Retailing features the fastest mean-reversion and highest trade frequency. Robustness checks—including random-pair bootstraps, threshold sensitivity tests, and stress-period performance during the COVID-19 shock—confirm that profitability is not driven by data-snooping or microstructure artifacts. Overall, the findings provide new evidence that high-frequency statistical arbitrage remains feasible in an emerging market setting, while highlighting the critical roles of execution speed, volatility conditions, and behavioral inattention in shaping trade-level outcomes.

View pdf

View pdf

With the development of the intelligent era, digital and Artificial Intelligence (AI) tools are widely used in daily life. In the field of corporate management, decision-making has evolved from simple operation control to intelligent performance analysis driven by technology tools. Correspondingly, management accounting also transfers roles from dealing simply with financial data to actively participating in company management and decision-making. Therefore, the integration of AI tools into management accounting decision-making systems becomes a main issue in the digital society. This paper emphasizes the usage and limitation of traditional management accounting from different aspects, such as technologies, staff, or organization, and analyzes the application of new intelligent tools in management accounting decision-making systems, extending risks and prospects. This survey mainly focuses on analyzing AI’s significant role in management accounting by case study and context analysis. Intelligent management accounting not only promotes financial goals in the company’s short-term management but also predicts analysis for future long-term goals. Therefore, this survey has important significance for improving company development.

View pdf

View pdf

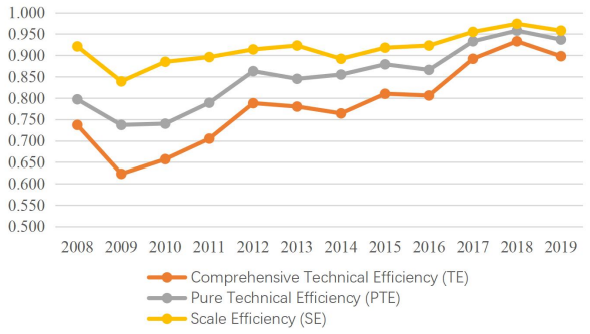

The development of sci-tech finance is conducive to promoting technological innovation and providing important technical support for comprehensively deepening reforms. Using the DEA-Malmquist model, a mainstream method for efficiency evaluation, this paper collects panel data on sci-tech finance of various provinces nationwide from 2008 to 2019, selects six input-output factors to measure the dynamic and static efficiency of sci-tech finance, and analyzes the results. It is concluded that the efficiency of China's sci-tech finance is mainly affected by pure technical factors; the eastern region performs better than the central and western regions; the total factor productivity of China's sci-tech finance has declined, while the central and western regions are developing well, along with other conclusions. Based on the empirical results, seven theoretical and practical factors are selected, and the Tobit model is used for empirical analysis. It is found that the level of internet development is significantly positively correlated with the efficiency of China's sci-tech finance and has a relatively large impact, while R&D expenditure investment is negatively correlated, and other factors are positively correlated. On this basis, suggestions for improving efficiency are put forward from three dimensions: strengthening innovation capabilities and technological progress, improving the management level of sci-tech and financial enterprises, and promoting the coordinated development of the eastern, central, and western regions.

View pdf

View pdf

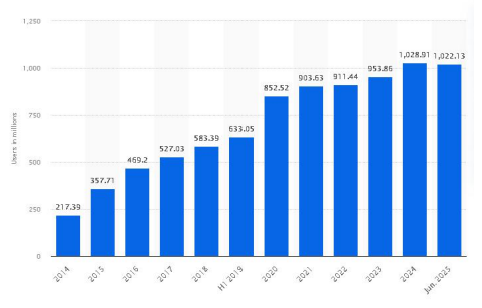

Recent research in financial technology (fintech) have significantly transformed the structure and operations of the global banking industry. In China, the rapid development of mobile payments, online lending platforms, digital currencies, and wealth management technologies has challenged traditional banking models, and the existing regulatory framework struggles to keep pace with these innovations. This study explores the impact of fintech integration and the regulatory environment on the financial performance of traditional commercial banks in China. Focusing on key areas such as payments, online lending, digital currency projects, and wealth management services, the study analyzes the significant differences in efficiency, profitability, and risk exposure across various fintech applications. This research, through the method of literature review, assesses how technological innovation is reshaping banking operations, customer behavior, and the competitive landscape within the Chinese financial system. The findings highlight the increasingly important role of a balanced regulatory approach in supporting innovation while maintaining financial stability and provide insights into the ongoing transformation of the Chinese banking sector.

View pdf

View pdf

Volumes View all volumes

Announcements View all announcements

Journal of Fintech and Business Analysis

We pledge to our journal community:

We're committed: we put diversity and inclusion at the heart of our activities...

Journal of Fintech and Business Analysis

The statements, opinions and data contained in the journal Journal of Fintech and Business Analysis (JFBA) are solely those of the individual authors and contributors...

Indexing

The published articles will be submitted to following databases below: